In this Financial Markets course, you will learn about all the aspects of finance and the specific trading markets implemented. You’ll gain an understanding of how they work, how they are regulated, and how they can impact your life. You’ll also learn about how different countries’ financial systems differ across the globe and why those differences exist.

You’ll begin by learning the basics of investing in stocks and bonds. You’ll then explore the role of central banks in stabilizing economies by creating money and controlling interest rates. In addition, you will examine how governments use fiscal policy to stabilize their economies during times of crisis or recession. Finally, you’ll learn about international trade agreements between nations and how these agreements have helped reduce barriers between countries over time.

Also, make sure to check out the Guide to Financial Markets: Why They Exist and How They Work.

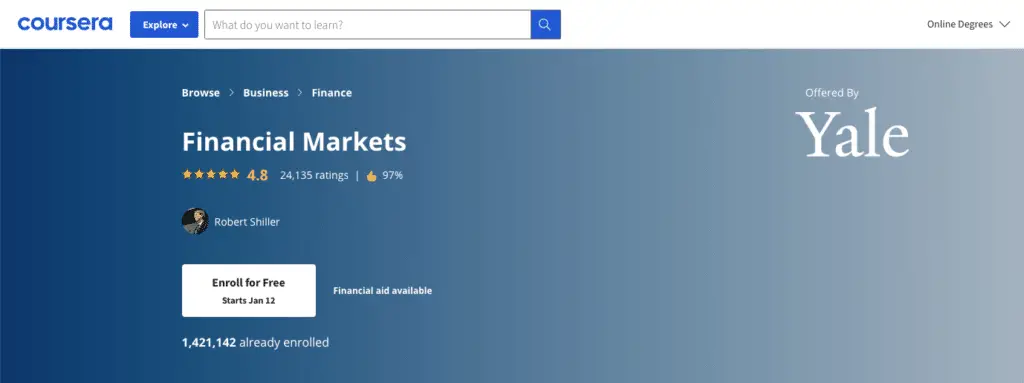

Financial Markets by Yale University

⭑⭑⭑⭑⭑ 4.8/5.0 – 22,707 ratings – 1,317,855 students

What Are the Different Types of Financial Markets?

Financial markets come in a variety of forms, each with special traits and purposes of their own. The most typical varieties include:

- Money Markets: These markets deal in short-term debt assets with maturities of less than a year, such as Treasury bills and commercial paper. Governments, businesses, and other organizations use the money markets to raise money and control their short-term liquidity.

- Capital Markets: Securities with maturities of more than a year are traded on capital markets, which also include the stock and bond markets. Both businesses and investors utilize these markets to purchase and sell stocks, bonds, and other assets. Businesses use them to raise long-term capital.

- Commodity markets: These markets deal in tangible goods like metals, energy, and agricultural items. To buy and sell raw ingredients and finished items, to producers and the consumers that use them.

- Markets for a foreign exchange deal in currencies and are used to promote worldwide business and investment.

- Markets for derivatives provide contracts with values derived from underlying assets including stocks, bonds, currencies, commodities, and market indices. They are employed in speculating and risk management.

- Real estate markets are those where real estate is bought and sold.

- Cryptocurrency markets: These markets deal in decentralized, non-centrally-controlled digital or virtual currencies, such as Bitcoin and Ethereum, which are not regulated by any government or central bank.

Every market is a part of the global financial system, which helps transport money, goods, and services throughout the world, and each one fulfills a different set of needs and functions.

Watch the entire Financial Markets course on YouTube

Financial Markets Course Overview

Financial Markets is a massive course offered by Coursera that explores the processes and systems behind the global financial market. The course is designed to be accessible to anyone with an interest in understanding how the global financial system works, whether you’re interested in personal investment or just want to know more about the world around you. The first half of the course covers basic concepts like stocks and bonds, as well as more advanced topics like derivatives and derivatives markets. The second half of the course focuses on macroeconomic topics including interest rates, monetary policy, inflation, and international finance.

In this Financial Markets course, you will learn about the structure and functioning of financial markets in the global economy. You will learn about the institutions, instruments, and participants that make up different types of markets. You will also explore how market participants use their strategies to try to maximize their profits and minimize their risks. Finally, you will learn about some of the key challenges facing policymakers as they try to manage financial markets effectively.

Financial Market Trading

Financial markets are a huge part of the world economy. In fact, they are so important that there’s a whole class of people who work in them: financial traders. Financial traders use their knowledge of the market to buy and sell assets (like stocks or bonds) in an attempt to make money by investing. The goal is to be able to buy low and sell high—that is, when an asset is low in price, you buy it because it will likely go up in price over time. When an asset is high in price, you sell it because it will likely go down in price over time. This course will teach you all about financial markets—what they are, how they work, how they affect the real-world economy, and more!

In this Financial Markets course, you will learn the basic concepts of modern financial markets, including the role of risk and return in investment decisions and the importance of diversifying your portfolio. You will also gain an understanding of how market prices are determined through analysis of supply and demand, as well as how prices form over time.

Course Reviews on ClassReviewed.com

There are no reviews yet. Be the first one to write one.

Have You Taken This Course? Submit Your Review

The Best Online Course Reviews

Search our database of the best online course reviews at www.ClassReviewed.com